French fintech panorama: where does Inovatic stand?

30 April 2024

French fintech panorama: where does Inovatic stand?

Truffle Capital and Finance Innovation, in partnership with Sopra Steria and BPCE , recently published the Fintech 100, which provides an overview of the fintech sector in France. Here we attempt to retrace these trends and decipher how Inovatic fits into the ecosystem. 173 fintechs responded to a questionnaire with the aim of measuring their economic performance, assessing their activity, their dynamism and attractiveness, and project the new challenges facing the sector. A ranking was then drawn up, with Inovatic in 82nd place. This year is characterized by consolidation in the sector, despite a decrease in the amounts raised. The emergence of AI is also reshaping the way French fintechs work.The growth and revenues of French fintechs

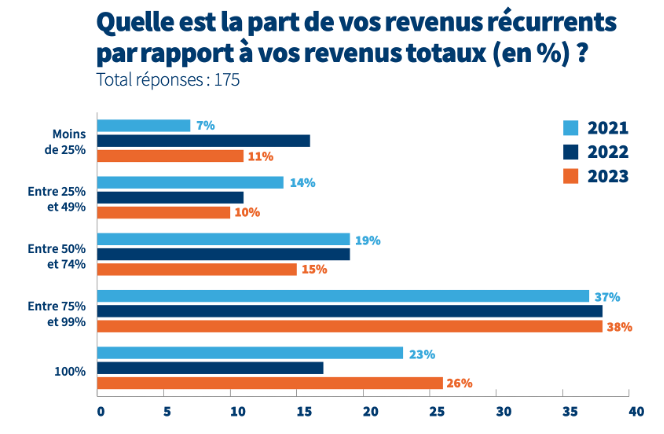

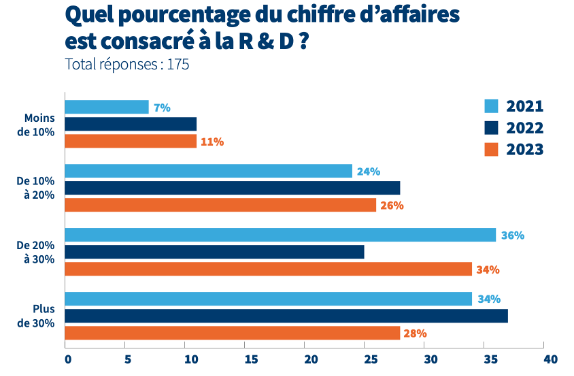

As a sign of a desire to establish sustainable growth, the majority of fintechs place their share of recurring revenue beyond 50% of their total revenue. Despite a still significant percentage of turnover devoted to RD, it is on average less important than in 2022. Two causes can explain this phenomenon: budget tightening and a shift to a more commercial phase. For its part, Inovatic dedicates more than 30% of its turnover to RD.

Despite a still significant percentage of turnover devoted to RD, it is on average less important than in 2022. Two causes can explain this phenomenon: budget tightening and a shift to a more commercial phase. For its part, Inovatic dedicates more than 30% of its turnover to RD.  |

|

Employment strategies of fintechs

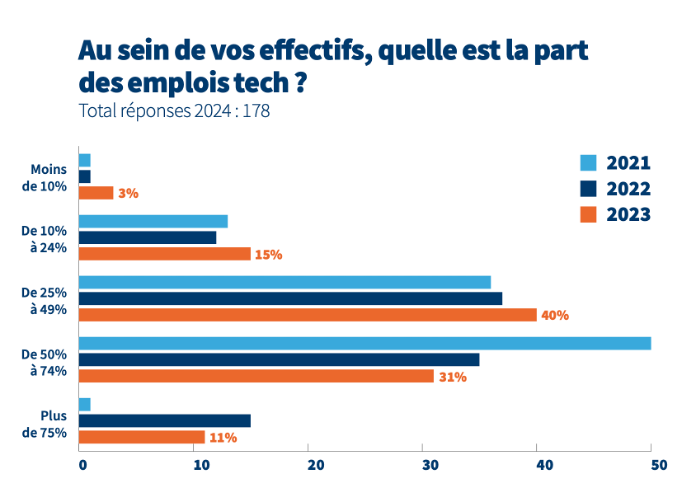

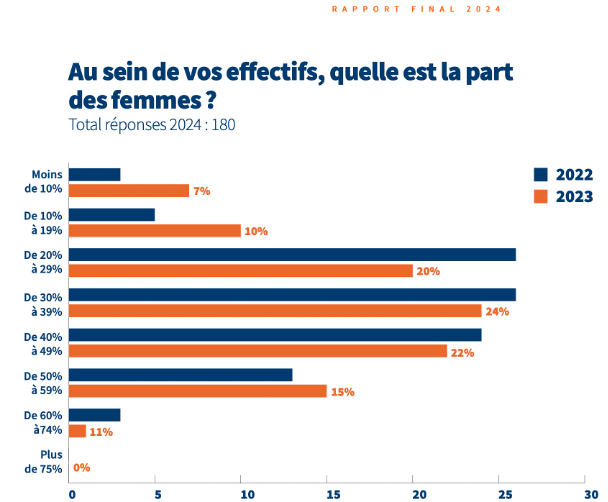

Although high, the share of tech jobs in French fintech is lower than it was in 2022: it was 42% in 2023, compared to 50% last year. Inovatic is within this average at 40-50% With around 60% women among its staff, Inovatic is above average in this criterion. This is in contrast to sector players, where this share tends to decrease.

With around 60% women among its staff, Inovatic is above average in this criterion. This is in contrast to sector players, where this share tends to decrease.  While these figures also tend to stagnate compared to 2023, Inovatic is engaged in several areas in terms of employment, whether in favor of diversity, international skills, or training, where the overall figure has gone from 70% to 45% in 2024. Inovatic also plans to recruit in the coming months, like the majority of companies in the ranking, which continue to create jobs despite the crisis.

While these figures also tend to stagnate compared to 2023, Inovatic is engaged in several areas in terms of employment, whether in favor of diversity, international skills, or training, where the overall figure has gone from 70% to 45% in 2024. Inovatic also plans to recruit in the coming months, like the majority of companies in the ranking, which continue to create jobs despite the crisis.

|

|

The activity and business model of French fintechs

Among the main sectors to which the fintechs listed in the ranking belong, insurtech comes first, followed by payment services, digital banking, and financing. While belonging to the latter sector, Inovatic is listed here as regtech. While the majority of companies today address B2B, Inovatic is above all an intermediary, with a B2B2B and B2B2C audience. Our clientele is mainly made up of banking institutions, insurers, and brokers. Like 49.2% of the companies surveyed, Inovatic works on system integration topics such as Open Banking or Bank as a Service. Following the current trend, Inovatic also works on machine learning techniques in artificial intelligence. Finally, we also work on infrastructure and platform technologies.International coverage

68% of fintechs have or are considering international coverage. However, this figure is lower than last year, a sign that the economic situation tends to hinder this type of project. Like Inovatic, most players target Western Europe or other European countries. Outside the continent, establishments are rarer, although they tend to develop in the Middle East, and major players often aim to develop in North America.Regulation

Upcoming regulations are numerous in the financial sector! Among them, those that could impact Inovatic's activity are three: the Financial Data Access, regulating open finance, the Data Act, and the Digital Operational Resilience Act (DORA). Among other notable European legislations, we can mention eIDAS2 (concerning digital identity) and DSP3, which regulates payment services.Partnerships, incubation, support

Like three-quarters of respondents, Inovatic established a partnership this year, which is of a commercial nature. The fact that this involves a banking group places us in the trend of fintechs this year, more than half of which have established this type of collaboration. While more and more fintechs are subscribing to an accompaniment program in 2023, we have decided to join Impact Germany by Business France to accelerate our growth in Germany. The arrival of new technologies and competition are the two main challenges currently faced by Inovatic. For most companies in the sector, the evolution of regulation is the main risk they face.AI-related challenges

With the popularization of ChatGPT in 2023, artificial intelligence was at the forefront. This emergence contributed to creating new dynamics within companies, changing their way of working. Like most industry players, AI allows Inovatic to optimize its client processes. It is also a cornerstone of our risk management and fraud detection solution. As for generative artificial intelligence, it is used at our company through solutions like ChatGPT in a private space. While most companies use it for marketing, at Inovatic, it is rather used to support IT development, research and development, and the optimization of internal processes. Ultimately, it is at the financial level that AI has had the greatest impact at Inovatic. Globally, it can be noted that while it did not contribute to reducing the workforce of most fintechs, it had an impact on employment by promoting training. While in 2023, the fintech sector experienced numerous transformations, between the emergence of AI and the repercussions of the crisis, affecting financing, it has shown resilience by relying on these new technologies and implementing sustainable models. Inovatic, which has launched many projects such as its internationalization, is part of this trend, without neglecting segments that tend to suffer from the current situation in some companies in the sector, such as the training of its employees, where we strive to maintain a certain diversity.Vous avez aimé cet article ? Partagez le sur les réseaux sociaux :